Yield curves after the rate cut: long-term vs short-term

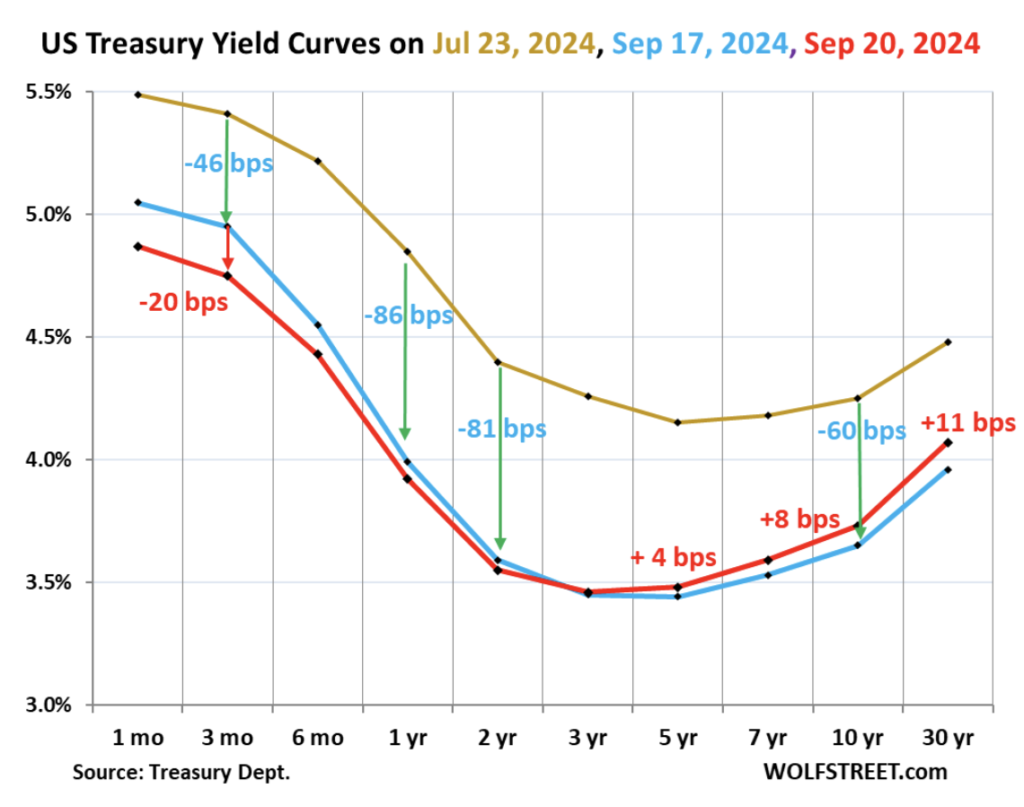

The Treasury yield curve is gradually shifting from an inverted state (where shorter-term yields are higher than longer-term yields) back to its normal state (where shorter-term yields are lower than longer-term ones). This shift is happening slowly.

Recent Changes in Yields: Since the Fed rate cut, shorter-term Treasury yields have continued to fall, driven by expectations of more rate cuts. However, longer-term Treasury yields (like the 10-year and 30-year yields) and mortgage rates have increased slightly.

Current Shape of the Yield Curve: The curve shows high but falling shorter-term yields, a dip around the 3-year mark, and rising longer-term yields. This reflects the market’s pricing in of expected future rate cuts by the Fed, causing shorter-term yields to drop sharply.

Yield Movements Before and After the Rate Cut:

- From July 23 to September 17 (the day before the rate cut), yields dropped across the curve in anticipation of multiple rate cuts. For example, the 3-month yield dropped by 46 basis points, and the 10-year by 60 basis points.

- From September 17 to 20, after the rate cut, shorter-term yields continued to fall, but longer-term yields rose, with the 30-year yield increasing by 11 basis points.

Why short-term yields drop but long-term yields rise?

The yield curve inversion usually signals concerns about future economic slowdown. However, as the Fed cuts rates, shorter-term yields fall, reflecting lower expected future rates. But longer-term yields are influenced by factors like inflation expectations and economic outlook. Since investors might see inflation risks increasing over time or anticipate stronger growth, they are demanding higher yields for longer-term bonds.

In this case, the yield curve is gradually un-inverting as shorter-term rates drop faster than longer-term ones. However, this is not favorable for mortgage rates, as those tend to follow longer-term yields (like the 10-year). So while the inversion is easing, mortgage rates remain high or have increased, which is not ideal for potential homebuyers.